Open Banking Is Coming to KL and Malaysian Banks Can’t Afford to Miss It

Bring Together the Brightest Minds in Banking, FinTech, and Regulation to Shape the Nation’s Open Finance Future

The world of finance is changing fast. Open banking is at the heart of this transformation—allowing customers to share their financial data securely with third-party providers via APIs, and in turn unlocking a wave of personalised services, seamless payments, and innovative financial products.

Banks that embrace open banking will be able to launch new services faster, build stronger customer loyalty, and compete head-on with agile fintechs.

Those that don’t risk being left behind in a market that’s becoming more connected and more competitive by the day.

But how can Malaysia’s banks embrace APIs securely and whilst protecting the critical data that gets shared between providers?

Malaysia Open Banking Summit | Shaping the Future of Open Finance with API Management

On 20–21 August 2025, the Malaysia Open Banking Summit at the Concorde Hotel Kuala Lumpur will bring together the brightest minds in banking, FinTech, and regulation to shape the nation’s open finance future.

Over two information-packed days, delegates can expect to hear from industry pioneers, hear about cutting-edge API solutions, and connect with the people driving the shift to a fully digital financial ecosystem.

From securing APIs to meeting new regulatory demands, this is where Malaysia’s open banking journey accelerates, and this summit is the launchpad for banking professionals to join.

A Summit Built on a Partnership of Innovation and Knowledge

This summit is made possible through the partnership of Incore Innovation Sdn Bhd, a Kuala Lumpur-based specialist in identity and data security solutions powered by biometrics, cryptography, Artificial Intelligence, and blockchain, and CyberSecurityAsia, a leading online news platform dedicated to cybersecurity professionals, delivering timely insights, industry analysis, and expert commentary for the Asia-Pacific region.

By combining Incore’s expertise in securing digital ecosystems with CyberSecurityAsia’s role as a trusted source of industry intelligence, they have created a summit that blends cutting-edge knowledge with practical strategies to propel Malaysia’s open banking ambitions.

Brazil: The Global Gold Standard for Open Finance—Live in KL

Brazil’s open finance revolution has been remarkable. In just a few years, the country has gone from traditional banking to a fully interconnected financial ecosystem spanning banking, insurance, investments, and pensions. The results? Greater inclusion, better competition, and services that truly put customers first.

Here’s the exciting part: We’re bringing some of the people behind that success to Kuala Lumpur.

You’ll hear directly from practitioners who have been directly involved in building one of the world’s most advanced open finance programmes—our hope is that delegates can learn from these strategies and ideas to make it happen here in Malaysia.

Sensedia: API Pioneers Who Have Helped Power Brazil’s Open Banking Success

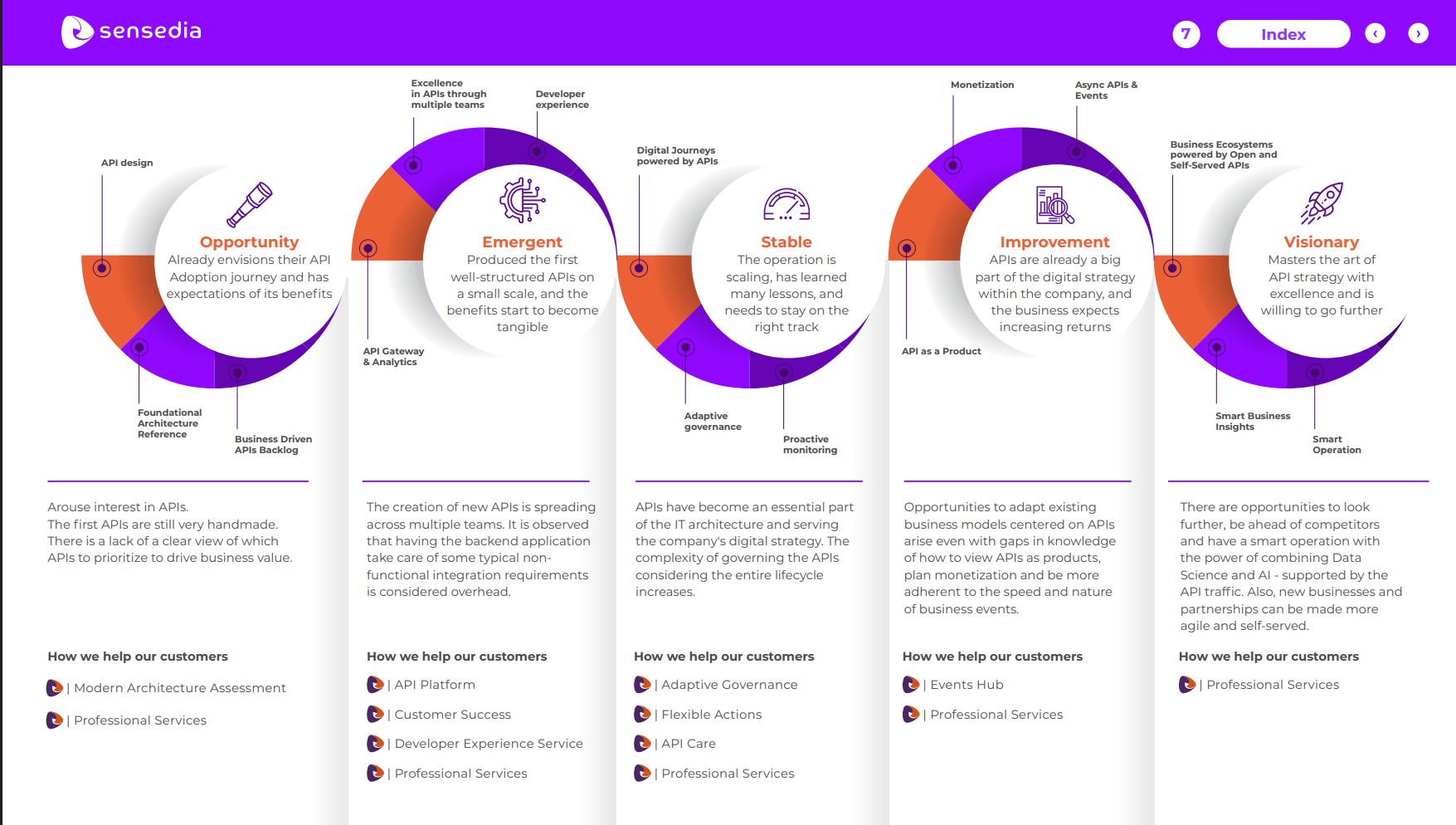

Among the headline speakers are Sensedia’s global experts, who played a hands-on role in shaping Brazil’s open finance landscape. Sensedia is recognised for its API Adoption Roadmap—a proven, five-stage blueprint that helps banks and enterprises move from early experimentation to visionary API-driven business models.

At the summit, Sensedia speakers will share real-world case studies of how Brazil navigated regulatory requirements, scaled API adoption across multiple teams, and transformed its financial ecosystem into a connected, customer-first powerhouse.

Their insights will be invaluable for Malaysian banks looking to leapfrog common pitfalls and fast-track their own open banking journeys.

The organisers want this event to be more than just another summit. They see it as a launchpad allowing delegates who attend to leave with:

- Actionable strategies to align with Malaysia’s open banking regulations.

- Global best practices from Brazil and beyond.

- Real-world insights into building secure, scalable API ecosystems.

- Connections that matter—from regulators to fintech innovators.

Malaysia’s open banking future is being written now—this summit aims to help you to help shape that future.