RHB Bank and PayNet Launch Innovative Soundbox to Fight Payment Fraud

RHB Banking Group (“RHB” or the “Group”), in collaboration with Payments Network Malaysia (“PayNet”), has launched the Dynamic DuitNow QR (“DNQR”) Soundbox with a keypad feature, marking a significant advancement in the Group’s efforts to combat financial fraud.

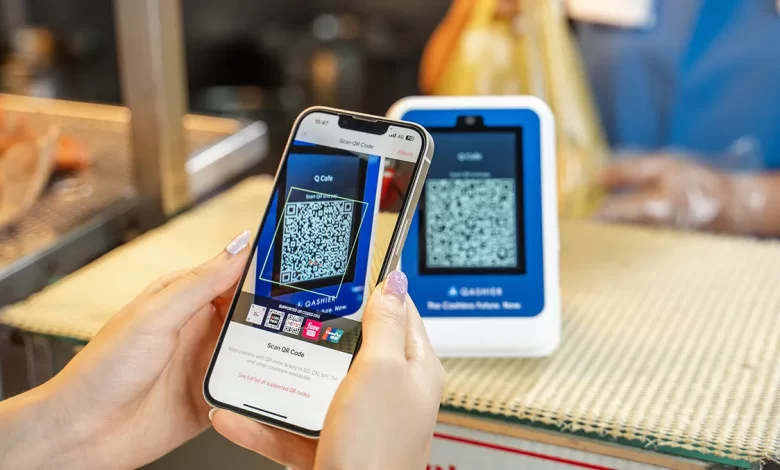

The Dynamic DNQR SoundBox is an innovative device supporting both static and dynamic QR payments, designed for seamless transactions, reducing human error, and enhancing operational efficiency. Equipped with an integrated calculator function, it accelerates payment processing, making it particularly beneficial for high-volume transaction environments such as food and beverage outlets and retail stores.

Dato’ Fad’l Mohamed, Managing Director, Group Wholesale Banking of RHB Banking Group, emphasised, “The Dynamic DNQR Soundbox exemplifies our commitment to safeguarding merchants and consumers in an increasingly digital landscape. Real-time voice and visual alerts provide reassurance and security, effectively mitigating risks associated with cashless transactions.”

Introduced in December 2023, RHB pioneered the DNQR Soundbox to safeguard transactions by way of voice and display notifications upon payment receipt while also combating fraud. RHB has successfully deployed nearly 4,000 DNQR merchants, of which 5,000 touchpoints were equipped with a DNQR Soundbox. This initiative has seen a substantial uptick, with over 600 new-to-bank merchants onboarded, witnessing a 33% increase in DNQR transactions from over 260,000 to close to 352,000, and transaction values rising from RM12 million to RM16 million within five months.

“We are thrilled to unveil the enhanced Dynamic DNQR Soundbox with keypad, a testament to our commitment to advancing financial innovation. This device embodies our vision under the Together We Progress 2024 (or TWP24) strategy, aimed at fostering inclusive growth across Malaysia. By year-end, our goal is to ascend to Malaysia’s Top 3 DuitNow Banks and significantly expand our Dynamic DNQR Soundbox network, empowering businesses and consumers alike in the digital economy revolution,” added Dato’ Fad’l.

In alignment with Bank Negara Malaysia’s fraud prevention initiatives, RHB continues to innovate to meet evolving customer needs. “Our focus is on empowering businesses, especially micro, small, and medium enterprises (MSMEs), with tools to safeguard against financial fraud. Starting with suburban MSMEs and expanding to high-volume transaction businesses, we aim to drive greater cashless payment adoption and contribute to Malaysia’s digital economy.”

Combatting fraud yields broad economic benefits, enhancing stability, operational efficiency, and public trust while reducing financial losses. The collaboration with PayNet underscores a shared commitment to bolster payment security and foster an inclusive financial ecosystem.

Azrul Fakhzan Bin Mainor, Senior Director, Commercial Division, PayNet, stated, “At PayNet, we believe that innovation and security go hand in hand. Our collaboration on the Dynamic DNQR Soundbox with RHB underscores our dedication to creating a secure, efficient, and inclusive digital payment landscape. By supporting the cashless agenda, we aim to drive greater adoption of digital payments, empowering businesses, and consumers alike to engage in safer, more efficient transactions. Together, we are committed to protecting consumers and merchants while advancing the nation’s digital economy.”

For more information about the Dynamic DNQR Soundbox, please visit this website.